*First, let it be duly noted that I am not a tax accountant or any sort of legal authority. All information provided below is for reference only. Please be sure to confirm the appropriateness of any and all actions you may take based on the information provided here with an appropriate authority.

While I have heard and read about what one should do, legally speaking, when becoming a freelance translator in other countries, I have not yet seen anything that covers becoming a freelance translator (or any other kind of freelancer) in Japan. In fact, it is exceedingly simple and painless. All you are required to do is file a single document, 個人事業の開業・廃業等届出書 (available here) with your local tax office (税務署; find the one nearest you here) declaring that you are starting your own business. There is no need to obtain a business license, tax number, etc.

Actually, like many laws in Japan, although you are “required” to file this document, there are no punishments for failing to do so. However, 1) you should do it because you are a good citizen, 2) it’s incredibly easy to file (see below), and 3) filing it enables you to enter the money you earn translating as business income (営業所得) on your tax return rather than as miscellaneous income (雑所得扱). It’s also required if you want to file the fabled blue tax return (青色申告), which offers all sorts of benefits for business owners but looks to be a real pain to file, so I’m not bothering with it for now (learn more from this pamphlet here).

You’re also supposed to file it within one month of starting your business but, again, there are no punishments for filing it later than this.

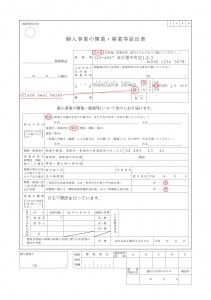

Anyway, as I said, filing the 個人事業の開業・廃業等届出書 is easy. The following instructions assume you are (or will be) a freelance translator operating out of your home and have no employees. I’ve provided an example form on the right. Click to enlarge.

First, in the 納税地 section, circle 住所地 and fill in your address and phone number. A cell phone number is fine. Next, since your “office” and home are the same, skip the next section (上記以外の住所地・事業所等) and fill in your name, circle your sex, and write in your birthday using the Japanese year system in the appropriate boxes. Don’t forget to add your seal (a signature may be acceptable as well – check with your local tax office). In the 職業 section, write “翻訳者.”

In the 届出の区分 section, circle 開業 at the top. The address line below that is only used when you move, so there’s no need to fill that in (conversely, should you move, you have to refile this document with your new address; you also have to file it again should you stop your work as a freelance translator and “close” your business, hence the 廃業 part). Below the address line, circle 新設 to indicate that you are opening a new office.

Skip down four sections to the section called 開業・廃業に従う届出書の提出の有無. There are two sub-sections here: 「青色申告承認申請書」又は「青色申告の取りやめる届出書, which concerns the application to use the blue tax return; and 消費税に関する「課税事業者選択届出書」又は「事業廃止届出書」, which is for consumption tax exempt businesses that wish to be taxed regularly. For both subsections, circle 無 (unless you want to do the whole blue tax return thing, in which case, consult with a staff member at the tax office first).

Lastly, in the 事業の概要 section, write “自宅で翻訳を行っています。.” That’s it!

Now all you have to do is give it to one of the staff at the main reception desk in your local tax office. They’ll stamp it and probably offer to give you a copy, as well. They won’t even ask to see your ID or visa status. There’s also no need to confirm anything – you’re all done! Just don’t forget to keep records of all your income and business expenses and file your tax return on time.